Article Directory

They're Throwing Us Scraps and Calling It a Feast

So, the headlines are practically screaming it from the rooftops: 30-year mortgage interest rates have dipped to 6.18%. The "lowest point of 2025!" Mortgage and refinance interest rates today, October 18, 2025: Rates hit their lowest point of 2025. Pop the champagne, I guess? Give me a break. Celebrating a 6.18% mortgage rate is like being grateful your captor loosened your chains by a single link. You’re still a prisoner. Let’s be brutally honest here: we’re being conditioned to accept a new, much crappier reality, and the financial media is acting as the PR department for our own economic confinement.

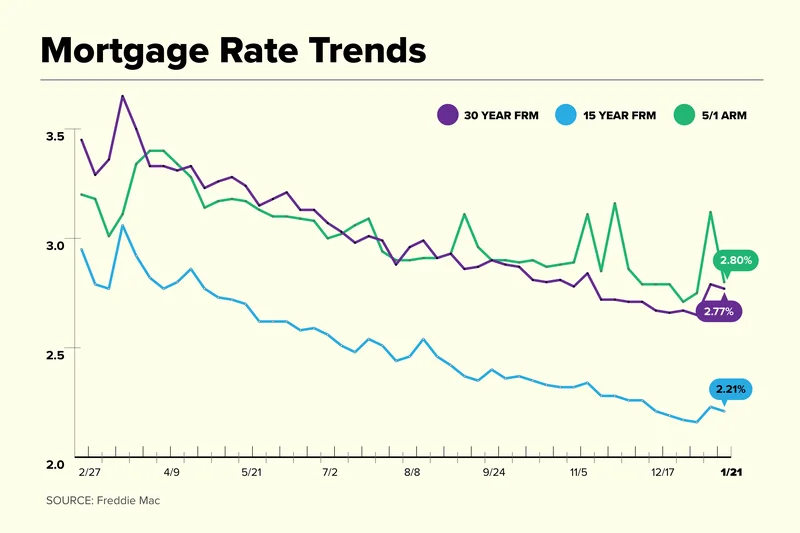

Just a few years ago, people were locking in rates under 3%. Now, we're supposed to throw a party because the rate isn't over 7% anymore? The goalposts haven't just been moved; they've been dismantled, melted down, and recast as bars on a window. This isn't a "dip." It's a pathetic consolation prize in a rigged game. The entire narrative feels designed to manage our expectations downward until we're thankful for any crumb they toss our way. And honestly, it seems to be working. I see people online talking about whether "now is a good time to buy," as if a 6% rate is some kind of gift. A gift? It's a 30-year financial ball and chain that’s twice as heavy as it was three years ago.

The whole thing is an exercise in gaslighting. They tell you, "Home prices aren't spiking like they were during the pandemic!" as if that's a win. No, they’re just stagnating at impossibly high levels while borrowing costs remain astronomical. It's like a casino dealer who stops hitting you over the head with a blackjack table and expects a thank you. The game is still rigged, folks. They just changed the method of extraction. Are we really supposed to feel good about this?

The Fed's Predictable Puppet Show

And then there’s the Federal Reserve. Oh, the Fed. Everyone’s waiting with bated breath for the meeting on October 29, where they’re almost certain to cut the federal funds rate by another 25 basis points. The CME Group's FedWatch tool puts the likelihood at 99%. Ninety-nine percent. It's less of a prediction and more of a spoiler for a movie we’ve all seen a dozen times.

But here’s the kicker, the part that makes the whole spectacle a complete sham: the market has already "priced it in." That's the phrase the experts love to throw around. It means lenders, bond traders, and all the other Wall Street ghouls have already adjusted for the cut. This is why we saw mortgage interest rates drop before the last few Fed announcements. It’s all theater. The Fed makes its grand pronouncement from on high, Jerome Powell puts on his best "concerned dad" face at the press conference, and for the average person looking for a loan, absolutely nothing changes.

This is a bad system. No, 'bad' doesn't even cover it—this is a fundamentally broken charade. Why do we even bother with the ceremony? Is it just to give the cable news talking heads something to fill 24 hours of airtime? The real decisions have already been made by algorithms and investor sentiment, long before the official announcement. The whole thing reminds me of a parent telling their kid that Santa Claus is watching, when in reality, the presents have been sitting in the closet for weeks. The outcome is predetermined; the story is just for show. Could mortgage interest rates fall before the Fed's October meeting? Here's what to consider.

And while we're on the topic of systemic failure, the fact sheet mentions a government shutdown is "contributing to lower mortgage rates" but slowing down FHA and VA loan processing. Offcourse it is. One part of the machine breaks in a way that accidentally helps us a tiny bit, so another part has to jam up to make sure we don't get too comfortable. It’s the perfect metaphor for the entire American system right now—a series of cascading failures that we're supposed to navigate with a smile. It's exhausting.

Welcome to the New 'Normal'

The most insidious part of this whole cycle isn't even the high rates themselves. It's the slow, creeping acceptance that this is the new normal. Analysts from the National Association of Realtors and Pantheon Macroeconomics are all singing the same tune: expect mortgage rates to hover around 6% through 2026. Fannie Mae thinks they’ll land at 5.9% by the end of that year.

Read that again. The optimistic forecast is that in two years, things will be just as bad as they are today. We're not in a storm that's going to pass; we're in a new climate. The era of cheap money is over, and with it, the version of the American Dream that involved a reasonably priced home for the middle class.

This creates the "golden handcuffs" problem you hear about. Millions of people are trapped in houses they might have otherwise sold because they’re clinging to a 2.8% interest rate from 2021. They can't afford to move because buying a similar house would mean doubling their monthly payment. So the housing market grinds to a halt, inventory stays low, and prices remain stubbornly high for the few homes that are for sale. It's a vicious cycle, a feedback loop of unaffordability.

And what's the advice we get? "Improve your credit score." "Lower your debt-to-income ratio." "Shop around for lenders." This is classic blame-shifting. It frames a massive, systemic economic failure as a personal financial hygiene problem. As if the reason you can't afford a house is because you didn't budget hard enough, not because the entire system has been engineered to favor asset holders over wage earners. It's insulting. Then again, maybe I'm the crazy one for even expecting anything different...

So This Is Winning?

Let's cut the crap. This isn't a recovery. It isn't a "soft landing" or an "adjustment phase." It's a quiet, managed decline of expectations for an entire generation. We're being told to be grateful for a 6% mortgage rate because it could be 7%. We're being advised to polish our financial resumes to beg for a loan that will still bleed us dry for the next 30 years. The dream isn't dead; it's just been repriced to a level most of us will never reach. And the worst part is, they expect us to thank them for it.