Article Directory

Wall Street’s ‘Fear Gauge’ Just Spiked. This Isn’t a Glitch—It’s a Warning.

For months, the market has felt like a perfectly calm, impossibly blue ocean on a windless day. So placid, in fact, that you could almost forget the leviathans lurking in the deep. We’ve been sailing on the assumption that the waters would stay glassy forever. We grew complacent. We got comfortable.

Then, on October 10th, a fin broke the surface.

The CBOE Volatility Index—the VIX index, for short—surged 4.9 points to close at 21.31. For the first time since the lazy days of early August, the market’s vital signs showed a flicker of panic, as news broke that the VIX Spikes Above 20 After Trump's Tariff Threats. But the “why” is almost less important than the “what now.” This jolt, this sudden spike in the stock VIX, wasn’t a random tremor. It was the system’s first gasp for air after holding its breath for far too long.

When I saw the VIX price chart that afternoon, I didn’t feel the panic that rippled through the trading floors. Honestly, what I felt was a strange sense of clarity. This is the kind of breakthrough that reminds me why I got into this field in the first place—not to predict numbers, but to understand the human systems behind them. This wasn't a failure of the system; it was a feature. It was a warning light, blinking red on a dashboard we’d all chosen to ignore.

The Anesthesia of Stability

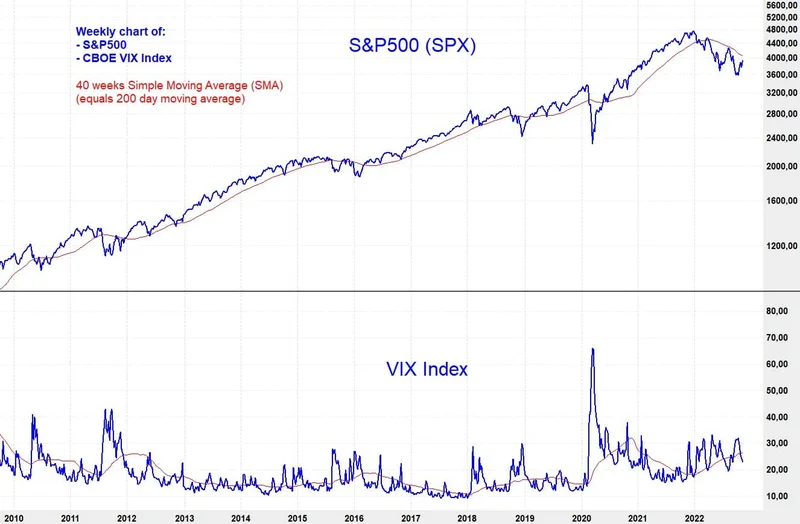

Let’s be clear about what we’re talking about here. The VIX is often called the "market's fear gauge"—in simpler terms, it's a real-time measure of how much chaos and uncertainty traders expect in the S&P 500 over the next 30 days. A reading below 20 is considered the zone of calm, the hum of a healthy, functioning machine. We’ve been living in that zone for a while now, lulled into a state of low-volatility anesthesia.

But stability and safety are two very different things. A system under anesthesia can’t feel the surgeon’s knife. Our collective focus on suppressing every minor fluctuation has created a market that is incredibly efficient but also terrifyingly brittle. We’ve optimized for smooth sailing, forgetting that the real test of a ship is how it handles a storm.

This is the central paradox of our modern financial architecture. It’s like a Jenga tower built by supercomputers. Each block is placed with micrometer precision, creating a structure that seems impossibly tall and stable, until someone opens a window. The tariff threat wasn’t a hurricane; it was a breeze. And the tower trembled. Why are we so surprised? Have we forgotten that just a few months ago, in April, a similar tariff-fueled selloff sent the VIX screaming to a high of 60.13?

A System Holding Its Breath

This is the reality of our hyper-connected world—a single policy threat whispered in a press conference can trigger algorithms in Singapore and panic traders in London before the coffee is even brewed in New York, a chain reaction that proves our global financial system is both a marvel of engineering and a terrifyingly fragile house of cards. We’ve built a system that transmits information, and fear, at the speed of light.

The question is no longer if these shocks will happen, but how we absorb them. Pretending they don’t exist, or hoping they’ll go away, is a strategy for catastrophic failure. The conversation on Wall Street is always about the next VIX premium or the smartest way to trade VIX futures, but we’re missing the forest for the trees. We’re debating the readouts on the seismograph while ignoring the tectonic plates shifting beneath our feet.

This brings us to a moment of real responsibility. We, the architects and participants in this global experiment, have an obligation to build more resilient systems. Not just more profitable ones. What good is a flawless engine if it shatters at the first sign of turbulence? What does it say about our priorities when our primary reaction to a warning is to find a way to silence the alarm bell instead of looking for the fire? The spike in the VIX today isn’t a problem to be solved; it’s a signal to be understood.

The Fever Is a Symptom, Not the Disease

So, where do we go from here? The headline that this event "could finally wake Wall Street" misses the point. It frames the jolt as the beginning of a problem. I see it as the beginning of a solution. A fever isn't the sickness; it's the body's attempt to fight it off. This VIX spike is a healthy, necessary immune response from a market that has been infected with the dangerous delusion of perpetual calm.

This is our chance to ask bigger questions. To move beyond the ticker tape and the daily charts. This is our wake-up call to start designing for resilience, to value robustness over short-term efficiency, and to finally acknowledge that in a deeply interconnected world, risk can’t be eliminated—it can only be understood and prepared for. The silence was the danger. The noise, however jarring, is the sound of a system trying to save itself.